lhdn website e filing

Bukan sistem yang biasa-biasa. Frasa keselamatan adalah bertujuan untuk memastikan pembayar cukai log masuk ke laman sesawang ezHASiL yang.

Lembaga Hasil Dalam Negeri Malaysia

Sekiranya menerima sebarang panggilan telefon SMS e-mel atau surat yang meragukan.

. Untuk maklumat lanjut atau sebarang pertanyaan anda boleh hubungi LHDN. Melayu Malaysia MYTAX Content. HttpsezhasilgovmyCI Bagi pengguna yang pertama kali login LHDN sila rujuk panduan berikut untuk e-filing.

Paling Sesuai Menggunakan IE. You dont need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return. Guide To Using LHDN e-Filing To File Your Income Tax.

Most recomended using IE Browser. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. Selain itu portal ini juga menyediakan pautan terus ke lain-lain perkhidmatan seperti ByrHasil baca Bayar Hasil e-Filing e-Kemaskini dan beberapa e lagi.

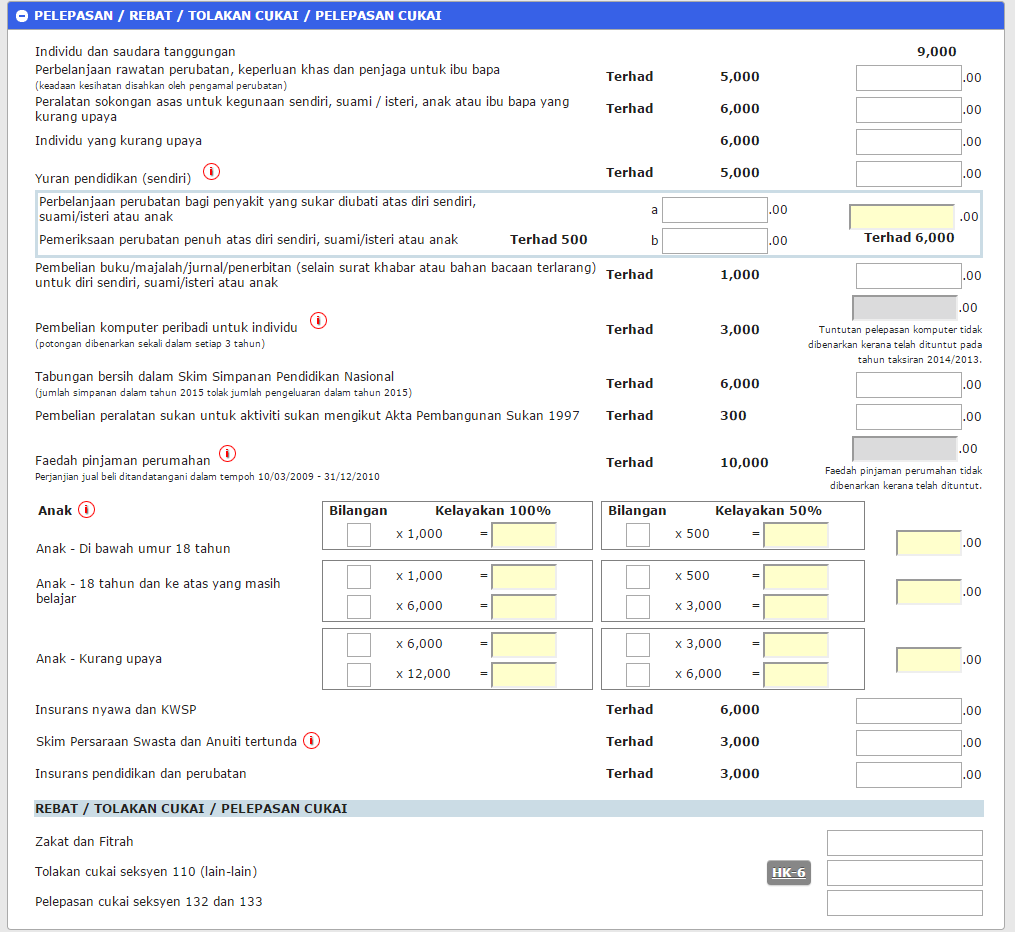

The application must be attached with the following documents. Basic supporting equipment for disabled self spouse child or parent. Select From Account to make payment and enter the.

Oleh itu lebih baik gunakan fungsi carian google. According to LHDN Income Tax Rates page the chargeable income tax in Malaysia for Year Assessment 2021 follows the following table. Sistem Akaun Lengkap untuk Bisnes Anda.

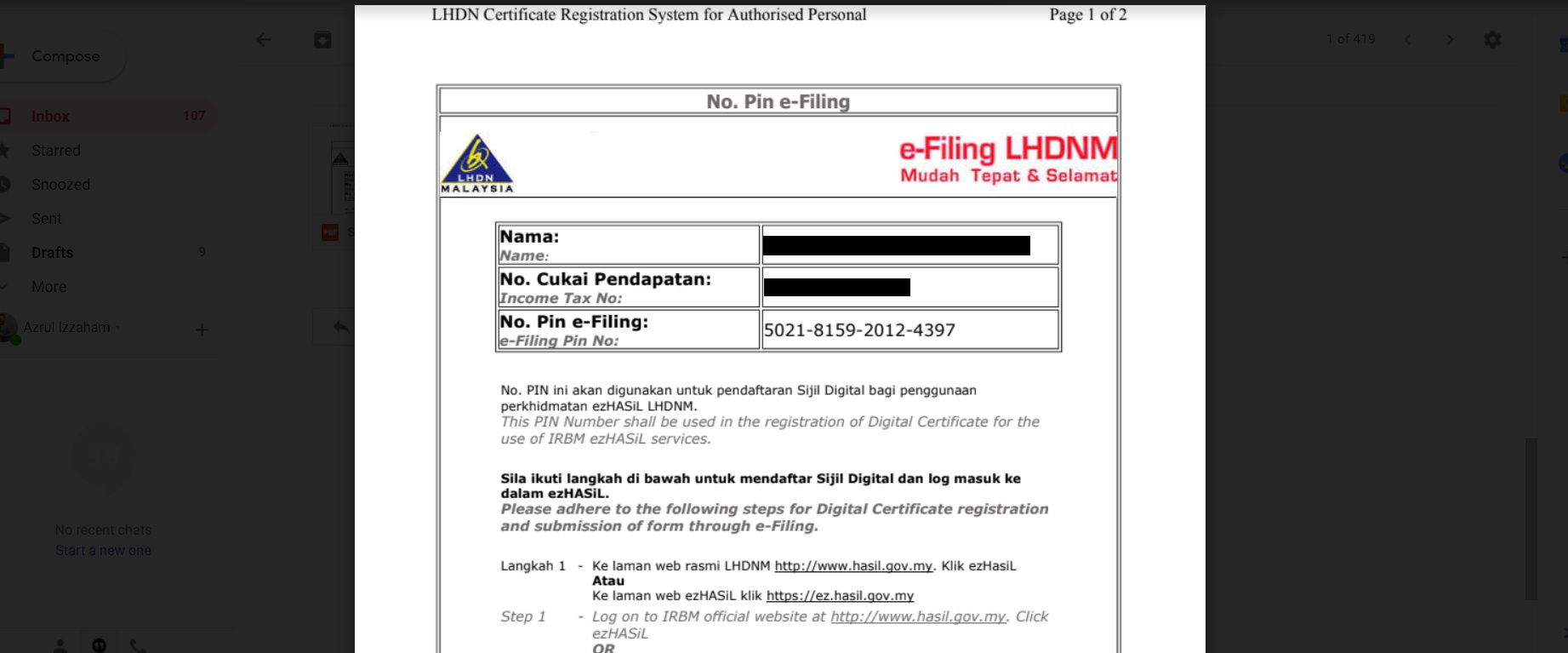

If you email address not registered with LHDN you have to fill up Online Feedback Form to obtain PIN Number. 82014 dated 1 December 2014 - Refer Year 2014. The reason you need this is to ensure that if you are above the paygrade that requires you to pay taxes the form ensures that you are aware of this and this is the form you use when you go online and do your E-Filing.

Melalui borang maklum balas atau hubungi Pusat Panggilan di 03-8911 1000. Lepas ni kalau setakat nak semak status terkini cukai pendapatan kita atau nak semak PCB yang majikan buat dah masuk ke lejar. Untuk membuat semakan e-filing sila login LHDN melalui pautan berikut.

Panduan Isi eFiling Cukai Pendapatan Untuk Kali Pertama. Automatic Exchange of Information AEOI Hidef CheckSchema. International Exchange of Information.

LHDN Semenanjung Sabah or Sarawak according to your tax centre location. Dengan Niagawan boleh nampak untung rugi keluar masuk inventori dan macam-macam lagi Jia Shamsuri Leader JS Global Empire. FRASA KESELAMATAN Mulai 27 Februari 2017 LHDNM akan meningkatkan keselamatan laman sesawang ezHASiL dengan memperkenalkan frasa keselamatan.

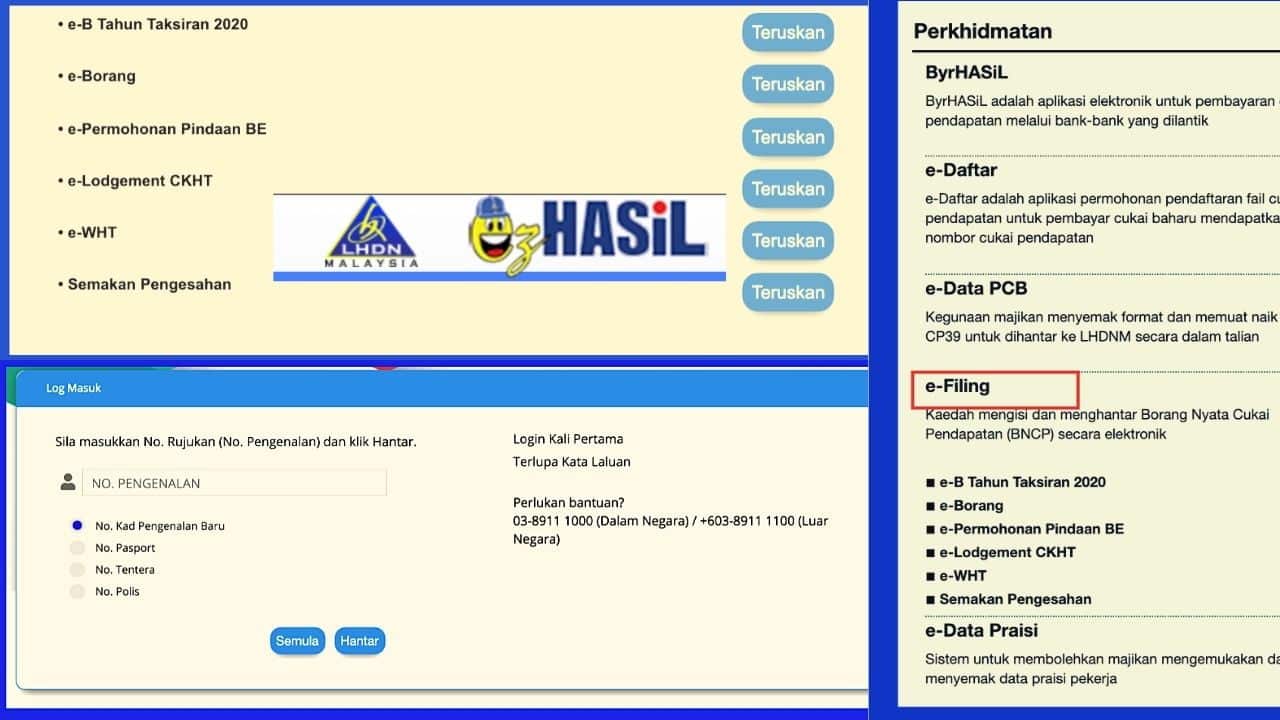

How much is taxable income in Malaysia for Year Assessment 2021. Pilih e-filing bagi mengisi borang cukai anda. If your email address registered with LHDN browse to ezHASiL e-Filing website and click PIN Number Application.

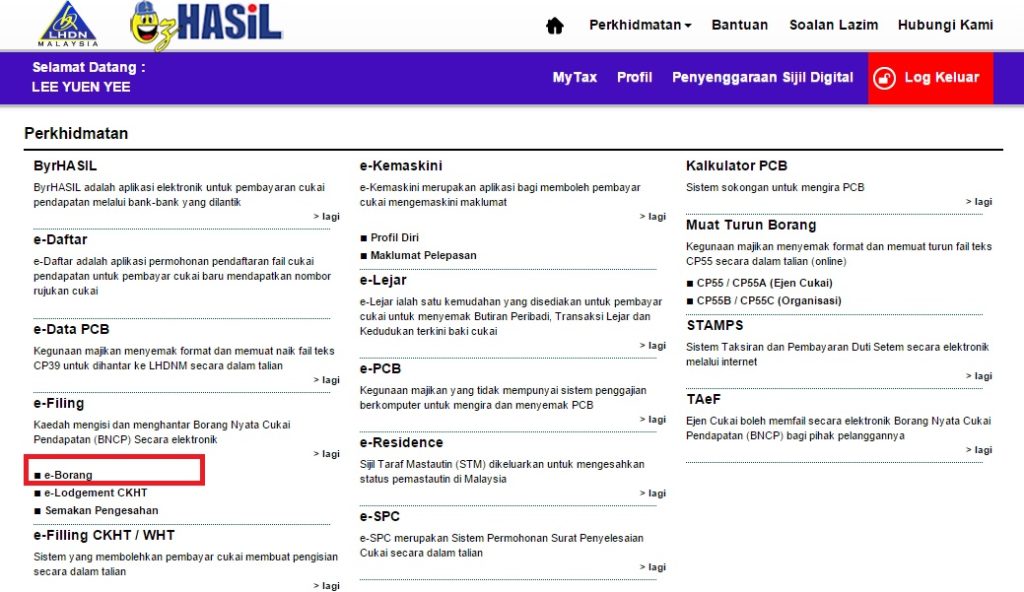

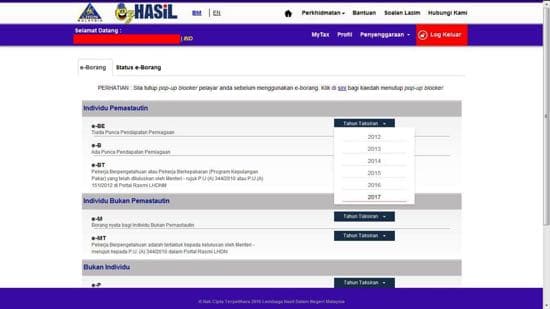

Frasa keselamatan adalah bertujuan untuk memastikan pembayar cukai log masuk ke laman sesawang ezHASiL yang. Antara borang yang tersedia di bawah menu e-filing adalah. Caranya adalah dengan login mengikut pautan ezHasil httpsezhasilgovmyci Masukkan nombor kad pengenalan dan klik hantar kemudian masukkan passwordkata laluan anda.

Enter your Income Tax file number excluding alphabets. Hak Cipta Terpelihara 2022 Lembaga Hasil Dalam Negeri Malaysia. How To Pay Your Income Tax In Malaysia.

Sekiranya anda memasukkan No. How To File Your Taxes Manually In Malaysia. FRASA KESELAMATAN Mulai 27 Februari 2017 LHDNM akan meningkatkan keselamatan laman sesawang ezHASiL dengan memperkenalkan frasa keselamatan.

E - Janji Temu. 1 Akses ke laman web e-Filing ezHASiL. Anda boleh akses e-Filing LHDN dengan.

MyTax - Gerbang Informasi Percukaian. Bergantung kepada pengurus website LHDN url diatas mungkin akan berubah dari masa ke semasa. Login e-Filing LHDN 2021.

Guna Google search untuk kata kunci ehasil ezHASiL atau LHDN. Click on the menu ezHasil services menu on the left-hand side of the screen then select e-filing. Taken directly from the LHDN website it is cited that referring to Section 831A Income Tax Act 1967 that every.

You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. Prosedur ini tidak terpakai kepada pembayar cukai yang membuat e-Filing melalui Ejen Cukai. After filing retain a copy of the forms for your records.

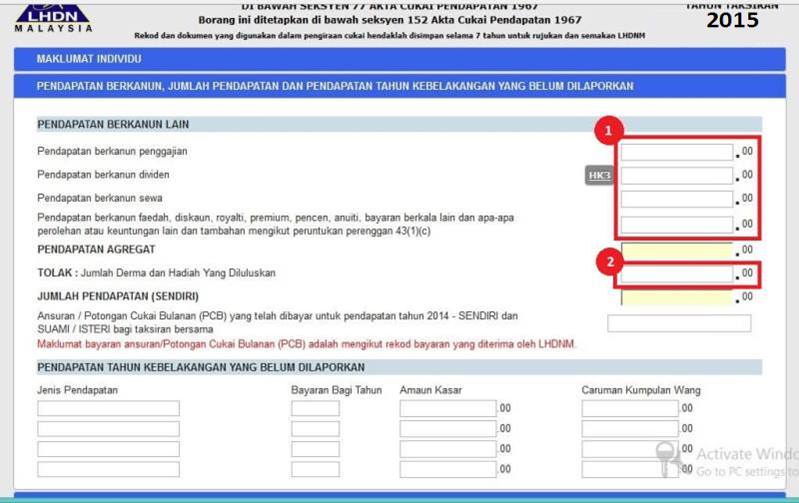

This option may vary depending on what type of income tax you are filing and you can refer to this table to help you figure out what to look for. Once the new page has loaded click on the relevant income tax form for the year. Return Form RF Filing Programme.

Pasport baru dan pernah menggunakan e-Filing tekan Ya. Anda boleh rujuk pada ringkasan yang disediakan untuk isi maklumat yang diperlukan di dalam borang e-Filing LHDN. All Right Reserved e-Apps Unit Department of e-Services Application Inland Revenue Board of Malaysia.

2022 Malaysia Income Tax e-Filing Guide For Newbies CompareHero. How To File Income Tax As A Foreigner In Malaysia. Hak Cipta Terpelihara Unit e-Apps Bahagian Aplikasi e-Services Lembaga Hasil Dalam Negeri.

E - Janji Temu. Pasport yang anda masukkan tiada dalam rekod. Tax Offences And Penalties In Malaysia.

Jika ini adalah kali pertama anda menggunakan e-Filing tekan Tidak dan lakukan Login Kali. E - Janji Temu. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

Prosedur ini tidak terpakai kepada pembayar cukai yang membuat e-Filing melalui Ejen Cukai. SEMAKAN TUNGGAKAN CUKAI LHDN SEKATAN PERJALANAN. Mytaxhasilgovmy Pengemukaan Borang Nyata BN Tahun Saraan 2021 dan Tahun Taksiran 2021 melalui e-Filing bagi Borang E BE B M BT MT P TF dan TP.

Personal Income Tax e-Filing for First Timers in Malaysia MyPF. Ducation fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

MyKad Card Police Military Card. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Basis Period For Business Non-Business Sources Companies Superceded by Public Ruling No.

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

Tanyazortax On Twitter Cara Paling Ringkas Untuk Declare Cukai Dekat Sistem E Filing Cara Ni Boleh Guna Pakai Bagi Income Makan Gaji Dan Juga Bisnes Twtcukaimy Twitter

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

Lhdn E Filing Your Way Through Tax Season Properly

How To File Your Taxes For The First Time

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Ctos Lhdn E Filing Guide For Clueless Employees

Overview Of The Inland Revenue Board Mytax Site

Ezhasil E Filing Login Account Pin Number Digital Certificate Application For Organization The Research Files

How To Reset Lhdn E Filing Password The Money Magnet

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

Tis The Season To File Your Taxes Again So We Thought We D Help You Out With E Filing Rojakdaily

Every Employer Needs To Submit Form E Eximius Ventures Facebook

How To File Income Tax For The First Time

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Comments

Post a Comment